Goldfinch

DeFi but drop the De. Real world loans powered by crypto are here!

Okay, so my last piece was pretty critical of the crypto ecosystem in its present form. I also used a bunch of fluffy and some might say explicit language, which my mom didn’t seem to like…

Today’s post is going to be more professional…

Remember at the end of the last article, I mentioned a couple of projects that are actually plugging into the real world? Today we’re going to talk about one of them: Goldfinch.

I had a chance to connect with their team and think that what they’re building is incredible. So let's get into it!

Goldfinch - Crypto loans for the real world

Intro to the protocol

Crypto loans for the real world!? What! Why? How?

Great questions… but, let's go back to basics before diving too deep into the specifics of Goldfinch. A blockchain, that weird database thingy that's immutable and permissionless, once it has a bunch of value on it it's really easy to change the record to say I sent this to this other person. In noncrypto land, we have all kinds of ways of doing this same thing that all require some third party to update the record. When we Venmo our friends, it's Venmo that does the record updating. When we fund our Venmo account, it's our card processor and our bank that do the record updating. When we send funds internationally, it's our banks using the Swift wire network that does the record updating. In fintech, these record-keeping networks are referred to as “rails.”

Each entity has its core accounting infrastructure and each jurisdiction has its own “rail” for updating balances between these different entities.

In crypto, the core banking infrastructure is also the rail.

Okay so now crypto loans, but in the real world. What do rails have to do with that?

Sorry to do this to you again, but before we can answer the question, let's ask another. What even is a crypto loan for the real world?

The second half of that question is as important as the first half. Loans in the real world differ from most loans today in crypto. Loans in the real world tend to process on traditional rails like Swift wire or ACH, and rather than requiring collateral like compound or aave, they require you to sign some kind of legal agreement saying you’ll pay the money back.

Usually, this process goes something like:

Go to bank

Fill out application

Get terms

Sign legal document

Wait for money

Call the bank, and ask where it is, but it's a Sunday so they don't pick up.

2 business days later get funds into your bank account

The reason that this process in traditional land is possible is that the bank has discretionary control over their depositors' value, meaning they have a ton of cash and can lend within the parameters of their risk department's controls. The reason it takes time for the loan value to arrive is that the rail it moves over has settlement periods because it was built back in the days when phones had circle thingies that you had to spin to dial a number.

But in cryptoland things don’t work that way. Users don't need a bank to hold their money for them, they hold their money in a wallet and they have control over what the funds get used for. Which makes a “real world loan” happening on-chain require a very different kind of flow.

It needs to be more like:

Post your terms

If people like it, get money

This works especially well in crypto land because all the value is already on the crypto rail and all of the interactions to lend to the borrower are a function of some code deployed on the blockchain known as a smart contract.

So back to the questions of what rails have to do with crypto loans for the real world: simplicity of capital movement, automation, and record keeping. Which, if we think about the purpose of a blockchain, that’s kinda the whole point.

Now that we have an intro to what goldfinch is and why a blockchain is relevant to it for more than just the buzzword, let's talk more about what goldfinch has done so far.

…and because goldfinch transactions all settle on-chain, we don’t have to really speculate about that or just use like random Wikipedia article data. We get to actually look at their performance, almost like a live audit using a tool called Dune analytics. https://dune.com/waseem/goldfinch

Looking at the data from the dune dashboard which is sourcing directly from Ethereum, we can see that goldfinch got its start in December of 2020 with 10k being lent on the platform. Fast forward a little over a year and a half, they have 102m being lent on the platform with 101m being borrowed and 878k in profit to the protocol. Not bad!

But now let's talk about what's actually happening. Who is lending? Who is borrowing? Can this operation scale?

In an article published by Hong Fan, this graphic was shared to contextualize the goldfinch flow of funds:

Lenders

The lenders can be any KYCd non-American individual or a KYCd American with accredited investor status. Considering this is a traditional lending operation brought on-chain, Goldfinch is required to know who is lending and who is borrowing on their platform and ensure no sanctioned individuals can participate so as not to break anti-money laundering regulations and comply with US securities laws. This greatly differs from many defi protocols as they are often permissionless, permitting anyone with capital on-chain to leverage the protocol.

Goldfinch as a central entity enabling this marketplace has opted to take the path of any centralized asset platform and require KYC. Their approach however is unique in that they instantiate a record of the user having been approved on the blockchain thereby not forcing the user to use a centralized intermediary, but rather just permitting them to use their decentralized marketplace. I think this type of requirement will only grow as time goes on. Maybe even leading to an ecosystem of regulated rollups and native chain souldbonded tokens representing the users' identity. Polygon has already taken this into account with their release of polygon ID.

Borrowers:

I think that the borrowers in the goldfinch ecosystem are the most interesting part of their ecosystem. These borrowers are not typical crypto borrowers wanting to take a position on the market with the assets they borrow. They are real-world companies running real-world businesses that need working capital for their operations.

With banking infrastructure and consumer debt being incredibly accessible from banking institutions in the EU and the US, a lot of the companies that end up going to Goldfinch are based in geographies that do not have the same capital market infrastructure.

One interesting function of Goldfinch requiring their users to go through KYC is that they can associate users to their geographic location on-chain. The goldfinch team used this data to create a widget on Dune where you can see the breakdown:

To learn more about the borrower archetype, Goldfinch published this great AMA with one of their borrowers, Cauris.

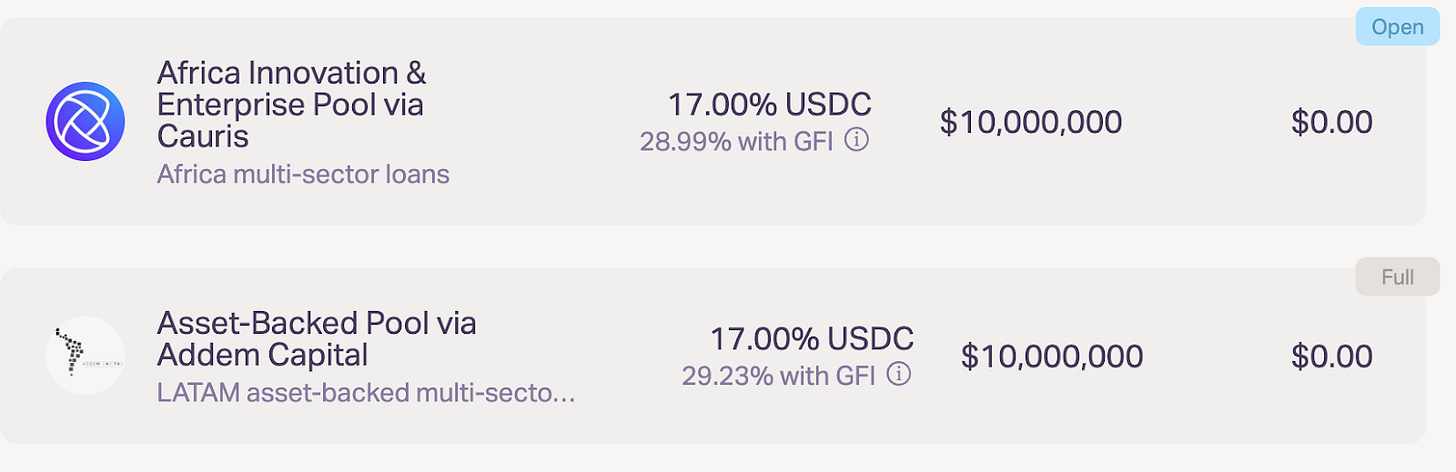

You can also see Cauris’s loan terms and access their data room via the Goldfinch platform: https://app.goldfinch.finance/pools/0xd09a57127bc40d680be7cb061c2a6629fe71abef

Challenges:

At a high-level glance with the growth in the value of loans being enabled via goldfinch, it looks like they’ve found product market fit. That said, when compared to the likes of Compound, the 100m in TVL is only 5.4% of the TVL of just stablecoins lent to compound. This means for goldfinch to reach the same scale, they need to grow 18.45x over. Considering their borrow value and deposit value are nearly 1:1 this means that they need to find 18.45x the borrow value that the platform has currently achieved and the same value in dollars willing to be lent.

This is no easy achievement. To some extent, it puts them in a similar kind of category to an investment bank. Needing to find both capital and places to deploy the capital. But considering the product is a self-serve platform, maybe a more apt analogy is something like a kiva or gofundme. Both of which are built on web2 infrastructure but have each grown substantially since their launch. For example, since 2010, gofundme has done 15b in fundraising value and kiva in 2011 did $223 million worth of loans went to over 556,000. (These values were taken from Kiva and gofundme respectively and unable to be audited on-chain.)

That said, in line with the borrower side adoption challenge, Kiva and Gofundme send funds to the user in a format that they are familiar with, bank or cash. Goldfinch gets the network effect of capital being already on-chain and easily deployable, but businesses do not use crypto rails yet. They have to find a way to offramp the value into local rails. This comes with a second-order downside of then all of the transactions no longer being auditable on-chain.

I think for real scale this in addition to growth in brand perception to borrowers and increase in trust of the platform to lenders will be key trends to follow along with to judge the execution of the Goldfinch team.

Conclusion:

I think goldfinch is an incredible project with a world-class team behind them tackling a very important problem in a market that has a lot of room for growth. They are setting a blueprint for how to build real-world businesses using crypto infrastructure and I am excited to watch them continue to grow.

Ideas/shower thoughts

What if users could get their USDC into an account that let them withdraw via bank rails, automated the off-ramping, and then also instantiated transaction records from the bank transaction log on-chain to enable the same transparency that a blockchain enables?

Could there be some kind of way to have a continuous risk scoring of the borrower based on off-chain data? Maybe similar to what xMargin does with Maple Finance.

Will the adoption of platforms like Goldfinch that benefit from the freedom of capital movement and aggregation of Ethereum end up causing global debt markets to find some kind of normal rate? Or will there always be some kind of risk premium associated with lending to different economies if users have to move value off-chain and into a local currency?

Will risk markets form around these loans? Maybe some big lenders will come together to underwrite multiple goldfinch loans in exchange for a portion of the yield?